| Taxation | Cap'n Trade | Conmmand&Control |

|---|---|---|

| Cost effectiveness | ||

| Yes, under condition | Yes under conditions: | No, very different implicit prices |

| If applied to all, with same price | If applied to all (high t.c.) | Unless cost & transaction costs are low |

| No free allowances | ||

| Uncertainty of cost uncertainty of quantities | ||

| Superior in simple framework, as quantities are a stock | Inferior, but quantités are a stock and investment is also | Very (too?) flexible, |

| Price stability is key to long term decision | Second order depends on comparative slope of marginal cost and marginal benefit | Long term efficiency (through banning) |

| Central bank type monitoring of market can stabilze price and mimick tax | ||

| Governance | ||

| Tax legislation, in the hand of finance committee in parliament, not green usually | Specific legislation committees | Very specific legislation up to arbitrary and opaque decisions |

| Use of receipts symbolically important (not relevant however) | no unanimity needed in the EU | open to lobby influence, hard to commit in the long term |

| very flexible to changes in technology | ||

| International agreements | ||

| In the UE tax legislation requires unanimity | international agreement and linkage possible | National only except trhough norms applied to imported products |

| International binding agreements impossible due to principle fiscal sovereignty | Free allowances can induce carbon leakage (hard to compensate with BTA) | |

| BTA | ||

| Possibility of capture or fraud | ||

| Strong institutions for tax compliance | Market manipulation possible, but not likely to be an issue | Impossible to equilibrate pressure |

| Manipulation of outcomes | ||

| Principle of equal taxation | Frauds due to different juridictions and linkage | Monitoring costs and frauds high |

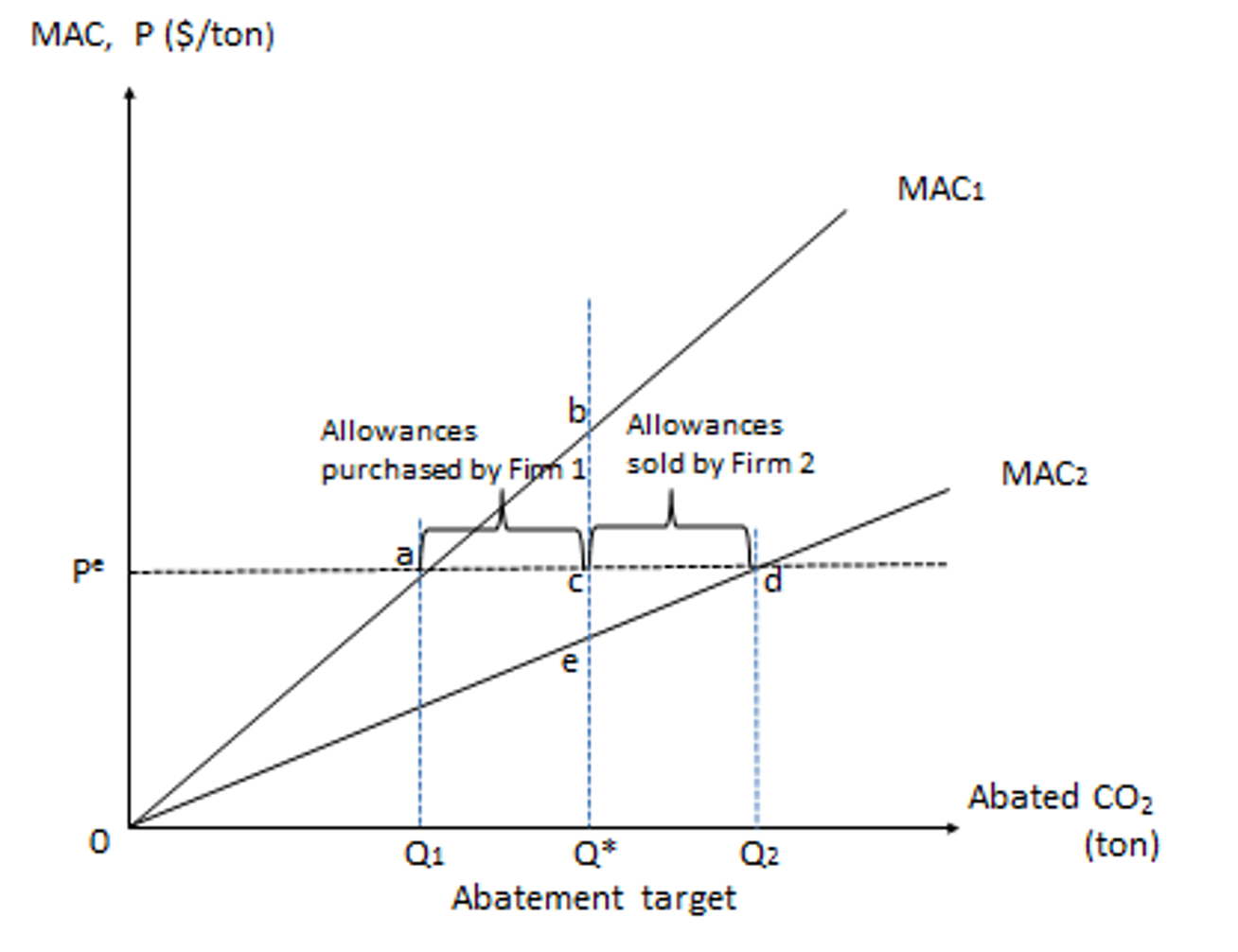

| Small number of units under trade scheme, caputure by lobbies likely (similar to interbank market) | ||

| Inter state compensation (hot air) | ||

| Information, monitoring and compensation | ||

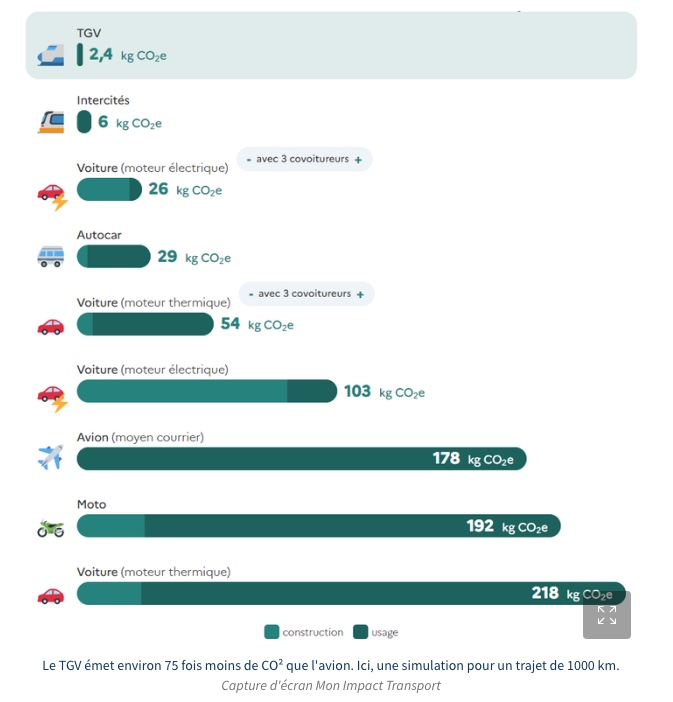

| Low costs if taxation is upstream for CO2 emissions | Low for large units, nearly impossible for small ones – taxes and t&c must coexist | Very difficult to monitor |

| High if monitoring is downstream | International markets raise taxation cooperation issues and free rider with another policies interactions | Compensation at the cost of higher emissions (tradeoff between target and compensation) |

| Compensation is difficult (downstream, high information and monotoring cost) or compensation is lumpsum kind (average compensation, double dividend) | Upstream compensation very easy | |

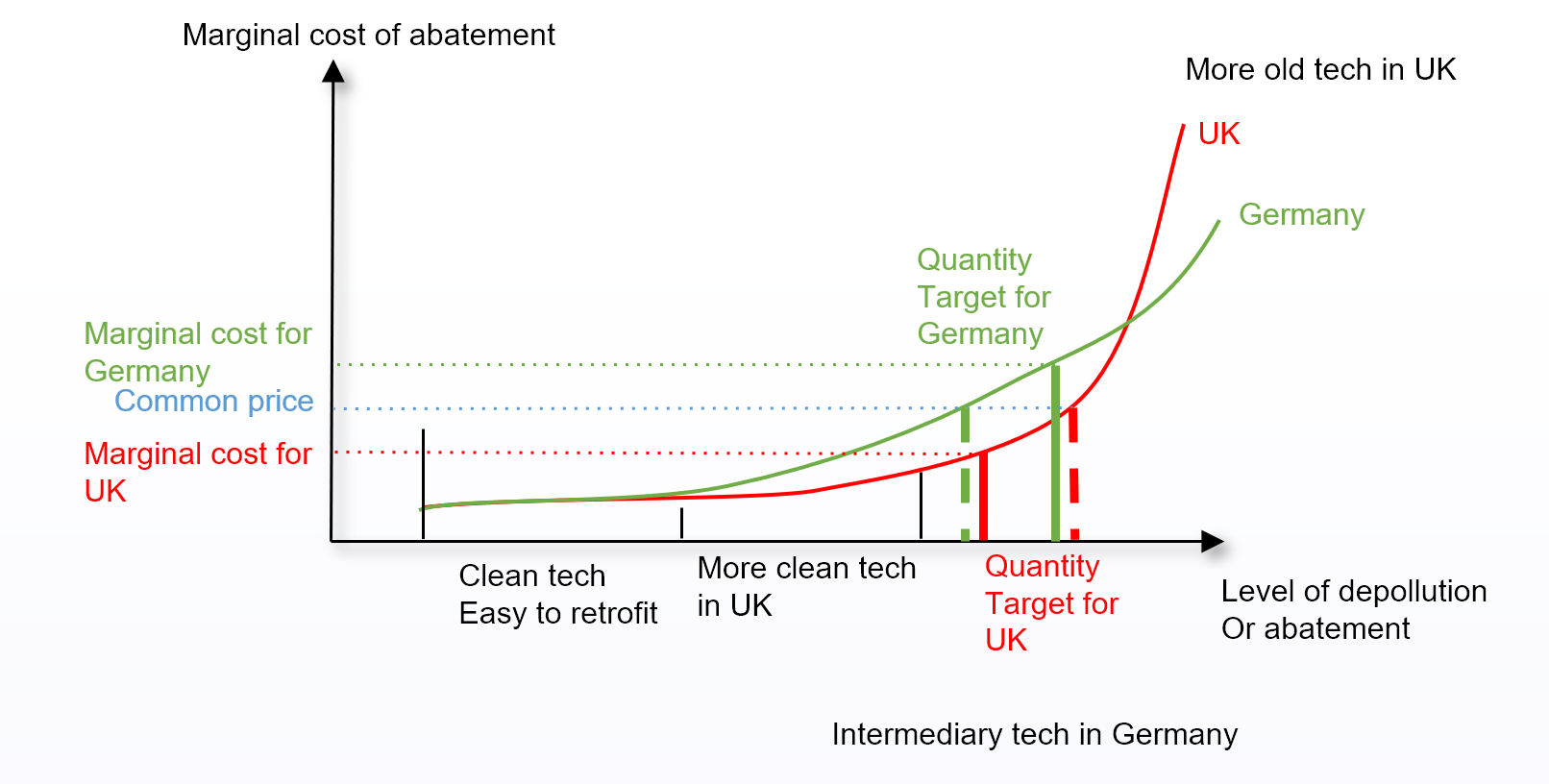

| Heterogenity | ||

| One size fits all | Easily reveal social cost | Very suited to tailored policies, with efficiency loss unquantifiable |

| Potentially corrected with BTA, with loss of efficiency | Limit extreme pressure on high polluters | |

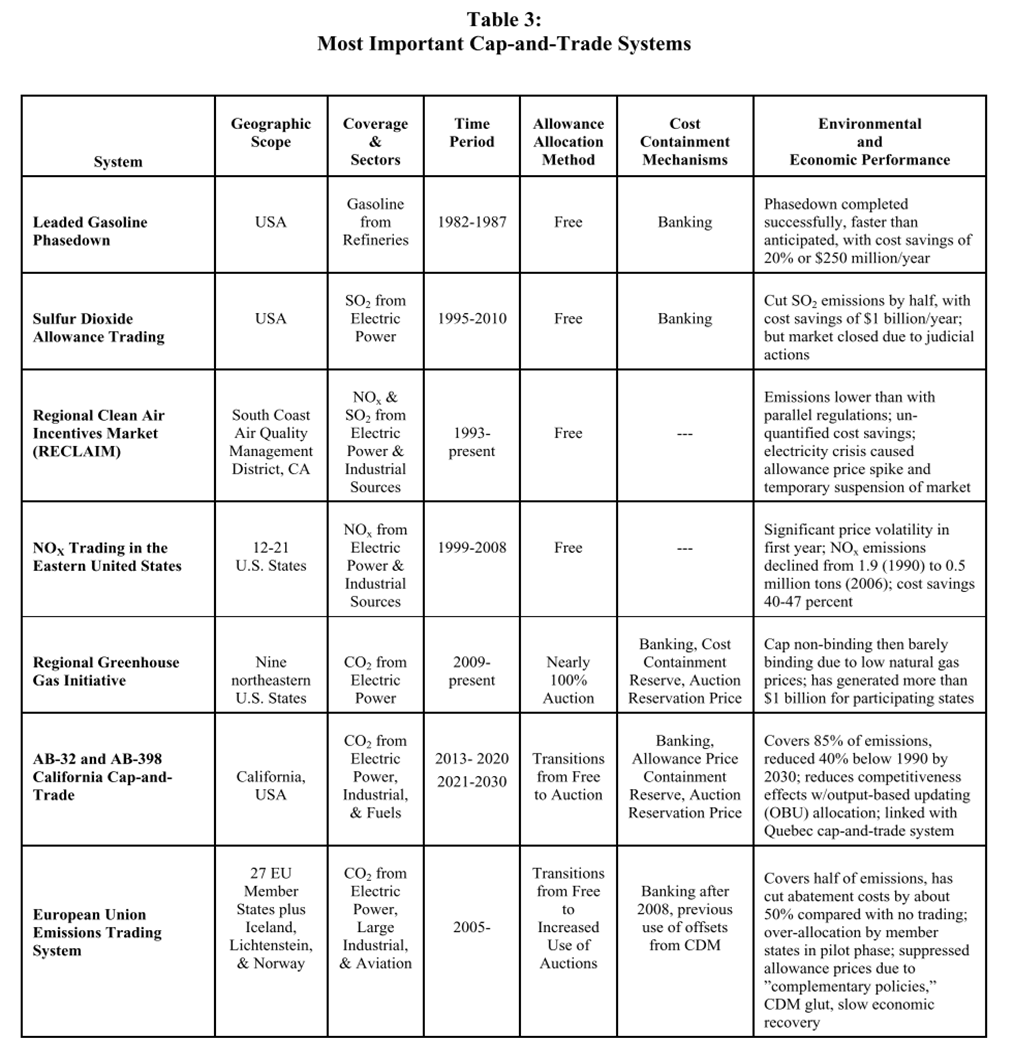

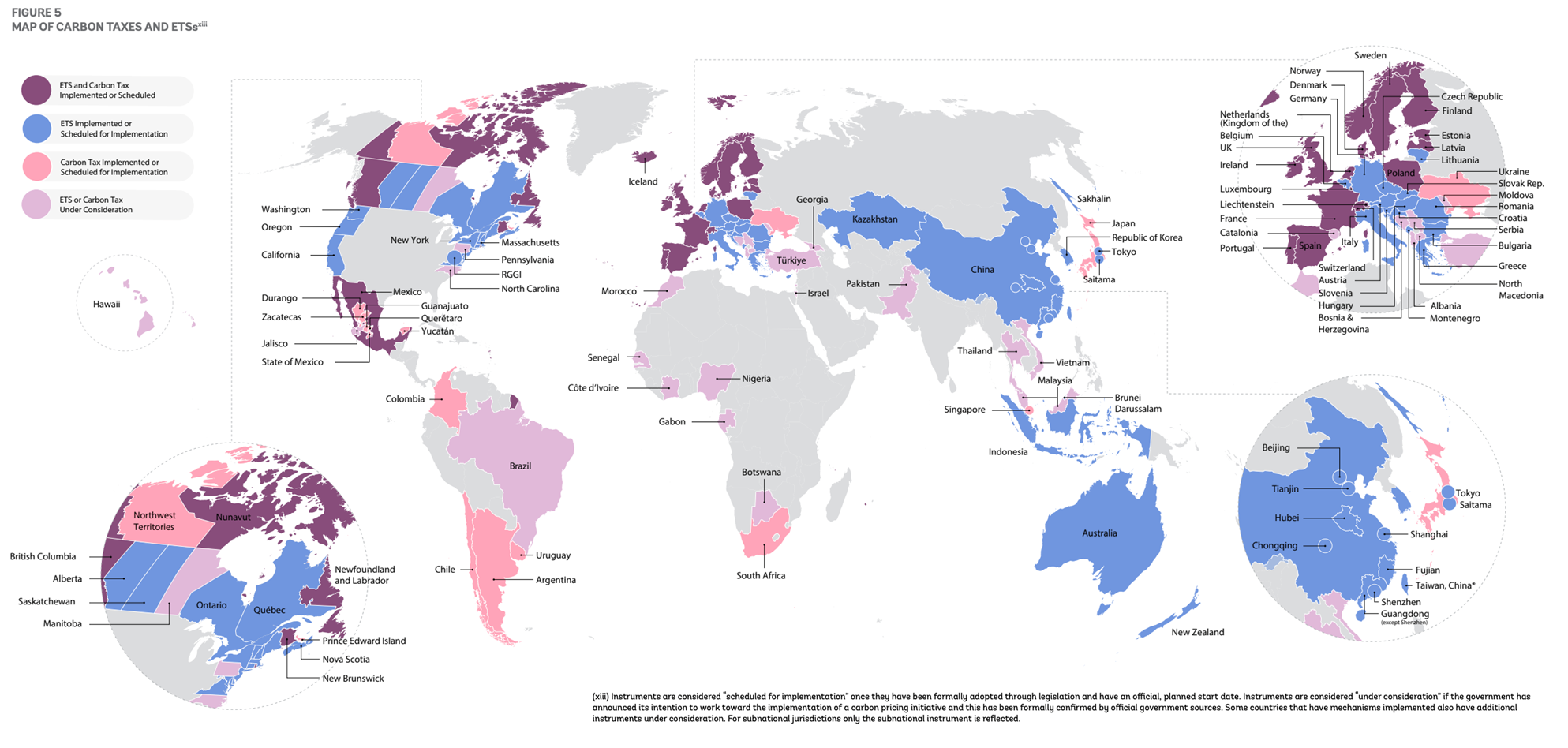

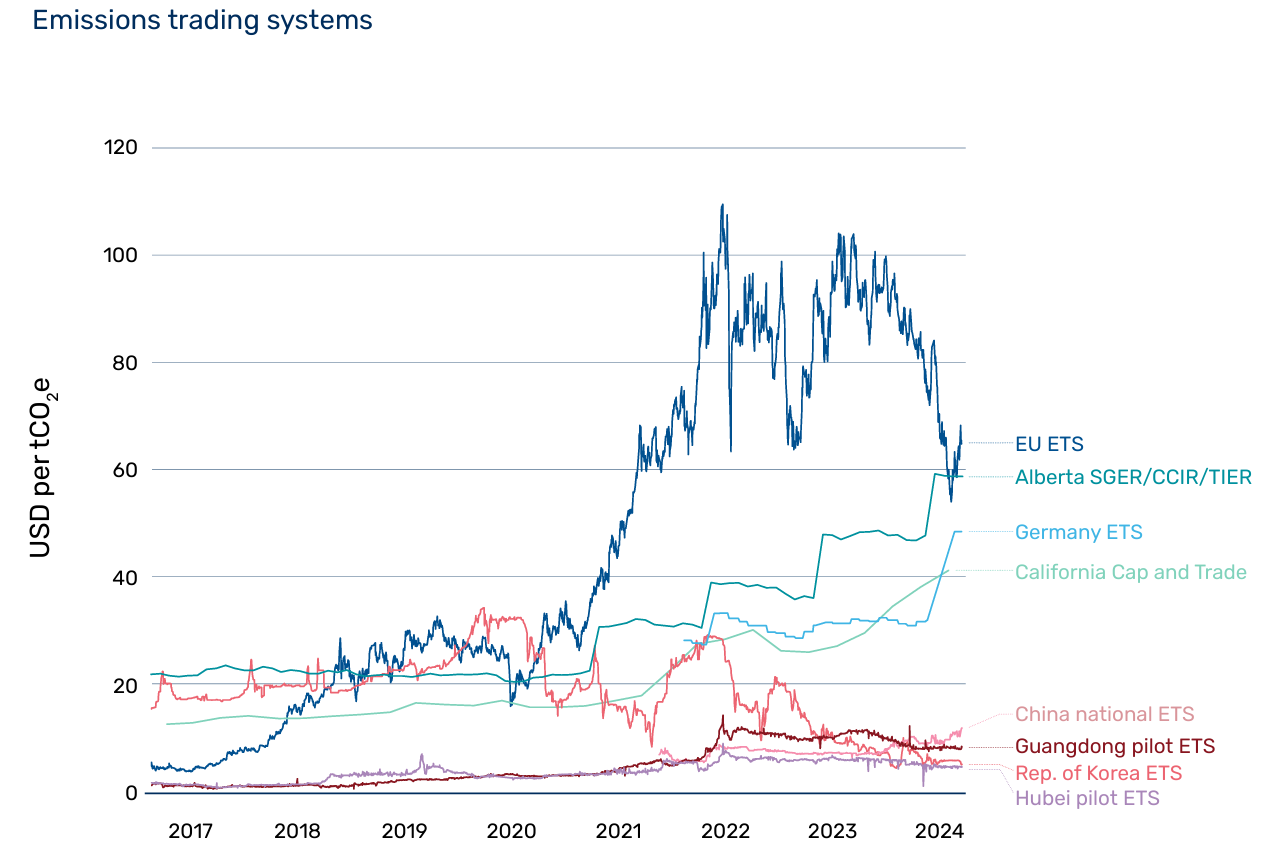

Main Carbon Markets

Stavins, R. (2019). The Future of U.S. Carbon Pricing (NBER working paper No. 25912)

Adding one important argument:

cap’n trade is under competition juridiction (technical, non qualified majority, not taken in account in tax burden) when taxes are under finance comitees

easier to decide and vote

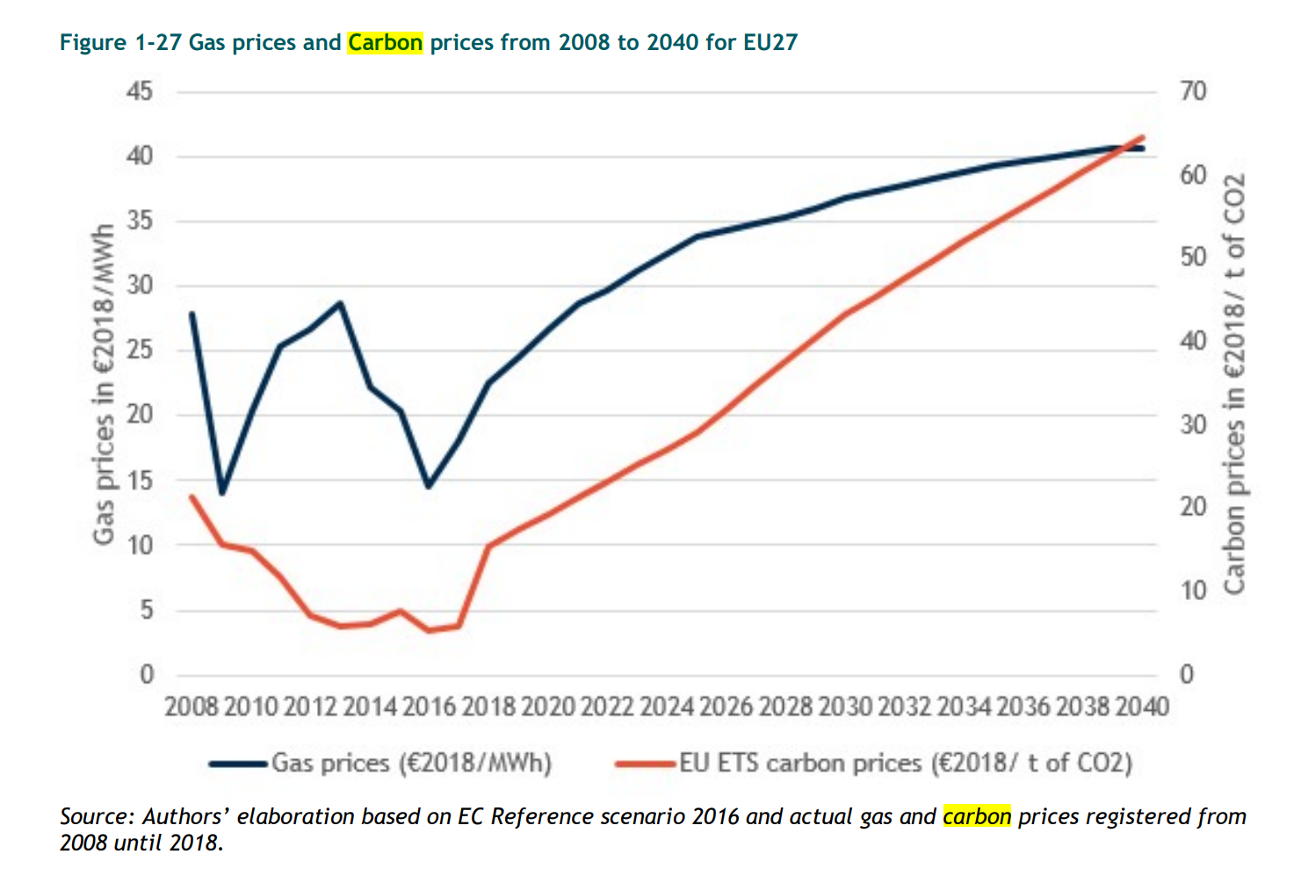

Expected EU ETS Carbon Price

Expected EU ETS Carbon Price